In the past five years, Low-code and No-code development platforms have taken significant market presence in Web development for Enterprise, Mid-Market, and Small-busineses. The immediate drivers are rapid and large-scale technical and business market changes as described by McKinsey, plus increasing reliability and security vulnerabilities and major changes in Consumer buying patterns and ongoing support expectations.

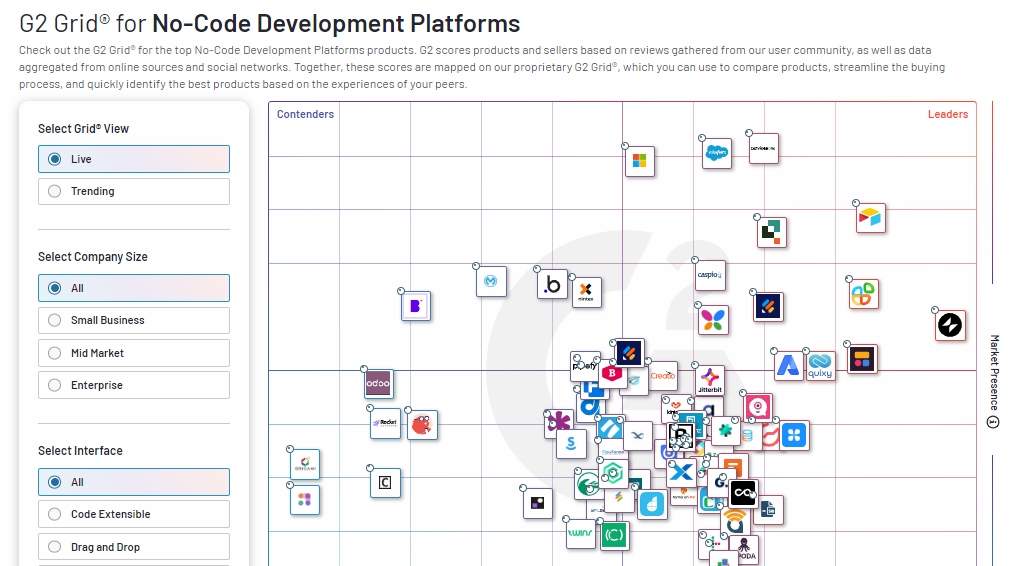

These factors have sparked equally large-scale changes in how Web development is done. The breakthrough is in Low-code and No-code toolset penetration into IT Systems development markets. G2 Grid shows 289 commercial tools in the Low-code market and 212 No-code applications.

The table shows 19 of the currently most popular low-code/no-code development tools.

But there is some consensus on what both low-code and no-code tools together deliver:

1 – Low-code/No-code toolsets deliver rapid application development with easy-to-use, drag-and-drop UI tools;

2 – Both toolsets lower costs by delivering working systems sooner and requiring less IT staff;

3 – Both toolsets encourage collaboration among IT and users as team members as work is completed co-operatively;

4 – Both toolsets allow rapid customization of templates and UI components with point & click ease so customization and refinements are easy to do;

5 – Both toolsets use performance-optimizing routines and cloud computing to substantially improve response time, security, and backend reliability;

6 – Both toolsets deliver sophisticated data connections both internally and externally with better integration routines breaking down isolated info silos

7 – Both toolsets offer process analysis and workflow methods to monitor and adjust projects jointly to changing conditions;

8 – Both toolsets emphasize broad monitoring of projects, ongoing analytics, and process mining methods to assure executives and team members a)that they have chosen the right solution set and b)that they are on track. For many projects, this is vital for the acceptance of a toolset.

However, there are some crucial differences between low-code and no-code toolsets. Perhaps the most obvious is that low-code platforms allow using programming tools like HTML, CSS, JS, PHP and other advanced coding tools. The trade-off is more advanced features and better runtime performance at the cost of code dependency, slower development time and/or some update risks.

In contrast, no-code development uses no programming code. No-code also supports drag and drop, point and click customizations – a challenge for some low-code tools. So the trade-off is faster development time, more design and styling options but with less access to advanced device features in the fast-growing mobile and IoT markets. Because of AI and rapid technical innovation what is now and will shortly be available to low-code and no-code toolsets is subject often to dramatic half-yearly change.

Financial Status of Low-code/No-code Development

Already low-code and no-code tools are earning close to USD24 Billion/year in 2023 and they have USD3.2 Billion from 2021 spread over 119 companies plus financial support from consolidations/acquisitions by major IT systems houses like IBM , Microsoft, and Oracle among others.

This is an enormous financial kitty for low-code/no-code developers to work from. For example, take USD24B for 2023 and spread it evenly among the 289 low code and 212 no-code developers, this works out to USD24 Billion / (289+212) = USD48.9 Million per toolmaker. To put this in perspective, Elementor’s annual revenues in 2022 is USD75.9M while WebFlow is USD84.1M and Instapage is USD21.9M.

And from the USD3.2B investment among 119 toolmakers, if you spread it evenly among those companies, they have had USD289M each to draw upon for the past 3 years. In sum, financially the low-code/no-code sector has had strong financial prospects for the past 3 years and into 2030. This is reflected in the mid-range monthly pricing of such systems drawn from our table above of 19 top low-code/no-code tools:

AppMaster.io – $160/month with limitations

Appypie.com – $60/mo but complex add-on costs

Bubble.io – $119/mo with complex pricing

SoftRio – $139/mo

Shopify.com – $79/mo + 5 staffers

As another example of financial prosperity, consider Builder.ai which received USD100M in investment financing in 2001. It has combined that financing with supporting AI routines to offer complete no-code development and support for 2-year periods in its services. Here is an example of how they help you create your app. With AI added to the money incentives, expect low-code/no-code development to mature rapidly and in unexpected ways.